Five Best Career Tests For Five Different Personalities

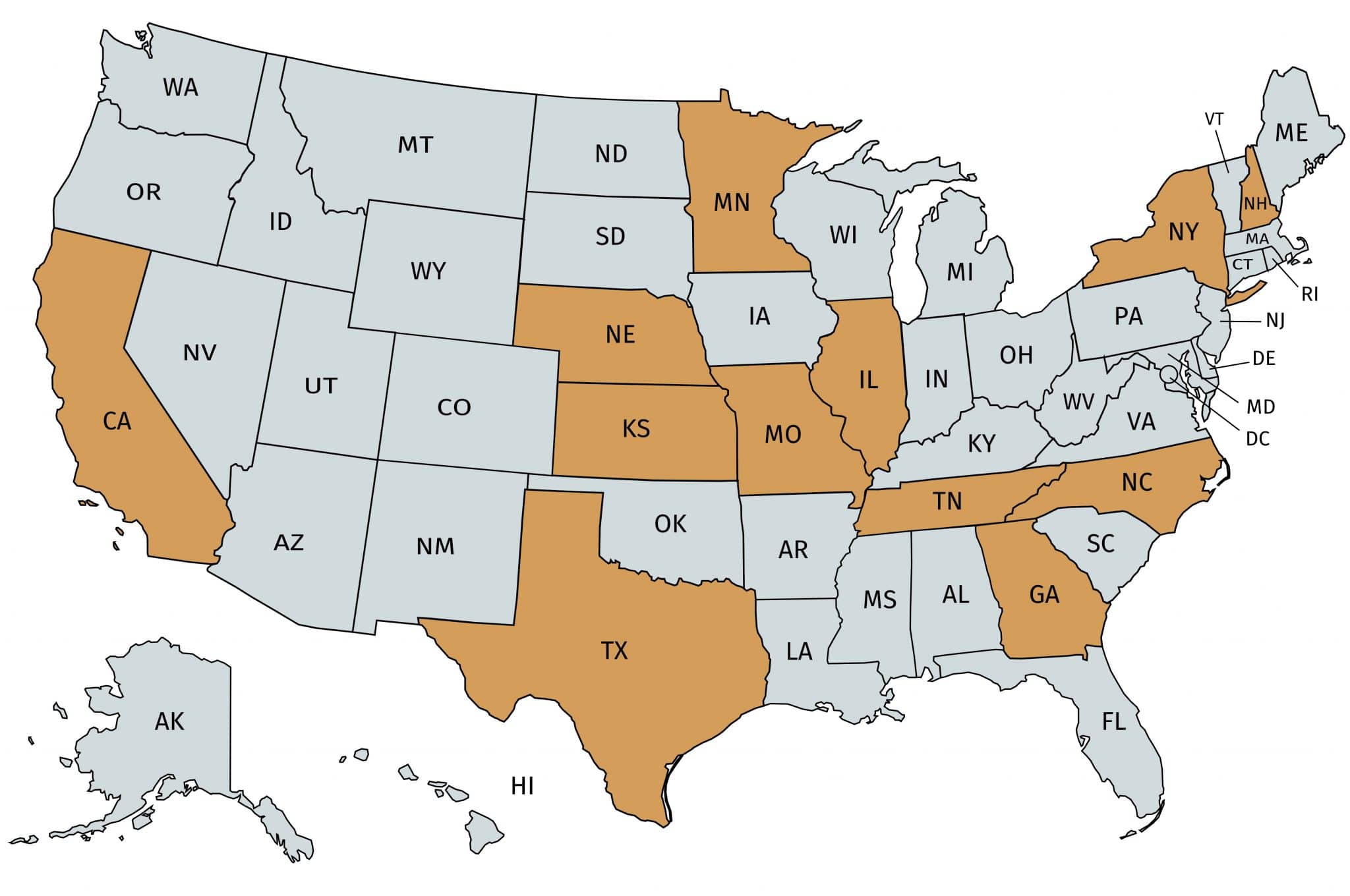

Discover your potential in the financial sector with the RTSWS Career Quiz, trusted by over 22,000 individuals, including RTSWS students, alumnae, and interested guests.

Gain insights to career options tailored to your interests and skills, showcasing a diverse array of opportunities within the financial industry.

DON’T FORGET TO VISIT OUR INTERNSHIP AND JOB PORTAL

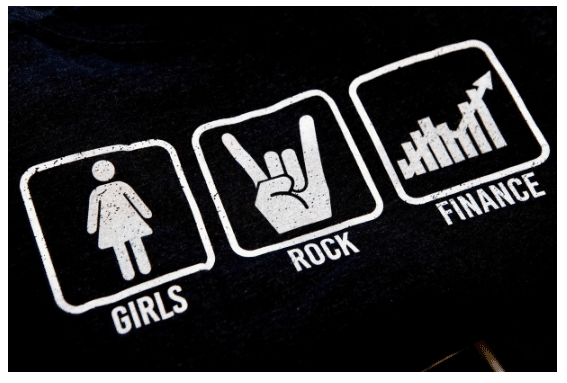

Editor’s note: As the mission of Rock The Street, Wall Street is increasing financial literacy rates among women and encouraging more women to pursue careers in finance, we are directing girls–particularly those still in high school or college–to take these tests and to not sell themselves short in STEM related topics, particularly math and finance. We know from doing our homework that girls start to lose interest in math at age 9–in spite of the fact that they perform as well as boys do. So, girls, whether it’s your inner financial analyst, your inner rocket scientist, your inner computer programer, let it out.

And if you’re not a high school girl? There are still tons of reasons to have a look at these career tests. As we all know, the days of picking one career and sticking it out for 50 years seems like a distant memory left by our Greatest Generation relatives. Adaptability is more important than ever as technology continues to change rapidly. So, whether you’re going through a midlife crisis, quarter-life crisis, looking for something to do part time during retirement, go ahead and enjoy these tests.

Career Test #1: Career Girls

Time estimate: 30 seconds

Link: https://www.careergirls.org/explore-careers/career-test/

Signup required? No.

Who would enjoy this career test? Girls, this career test is for you!

Test format: It only takes about 30 seconds to complete, as it simply asks you to check boxes of things you like, things you can do, and aspects of your personality.

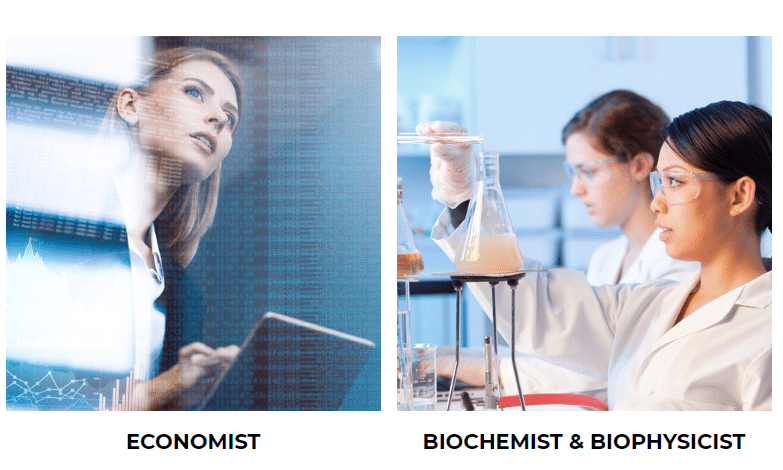

Results format: While the test itself is remarkably simple, the results are quite deep, with information on each profession ranging from skills needed to salary to educational requirements. Within each profession they not only have pictures of females doing the job, they also provide bios of real women who do them, from pulmonologists to athletic trainers. Each bio has videos of the woman discussing the path that led to her career, what the day-to-day looks like, and useful career advice. All in all, a great test for girls to see role models in many different industries and learn more about what they do.

Career Quiz 2: Your Free Career Test

Time estimate: 10 minutes

Link: https://www.yourfreecareertest.com/

Signup required? No

Who would enjoy this career test? Those of you who like to be thorough.

Test format: If you are one of those people that likes to have every possible contingency covered, then this test is for you. Further, this one is also great for those out there who prefer to search by the skills rather than personality. It is a slightly longer test, with 63 questions each asking about a particular skill which you have to then rate very interested, interested, slightly interested, or not interested.

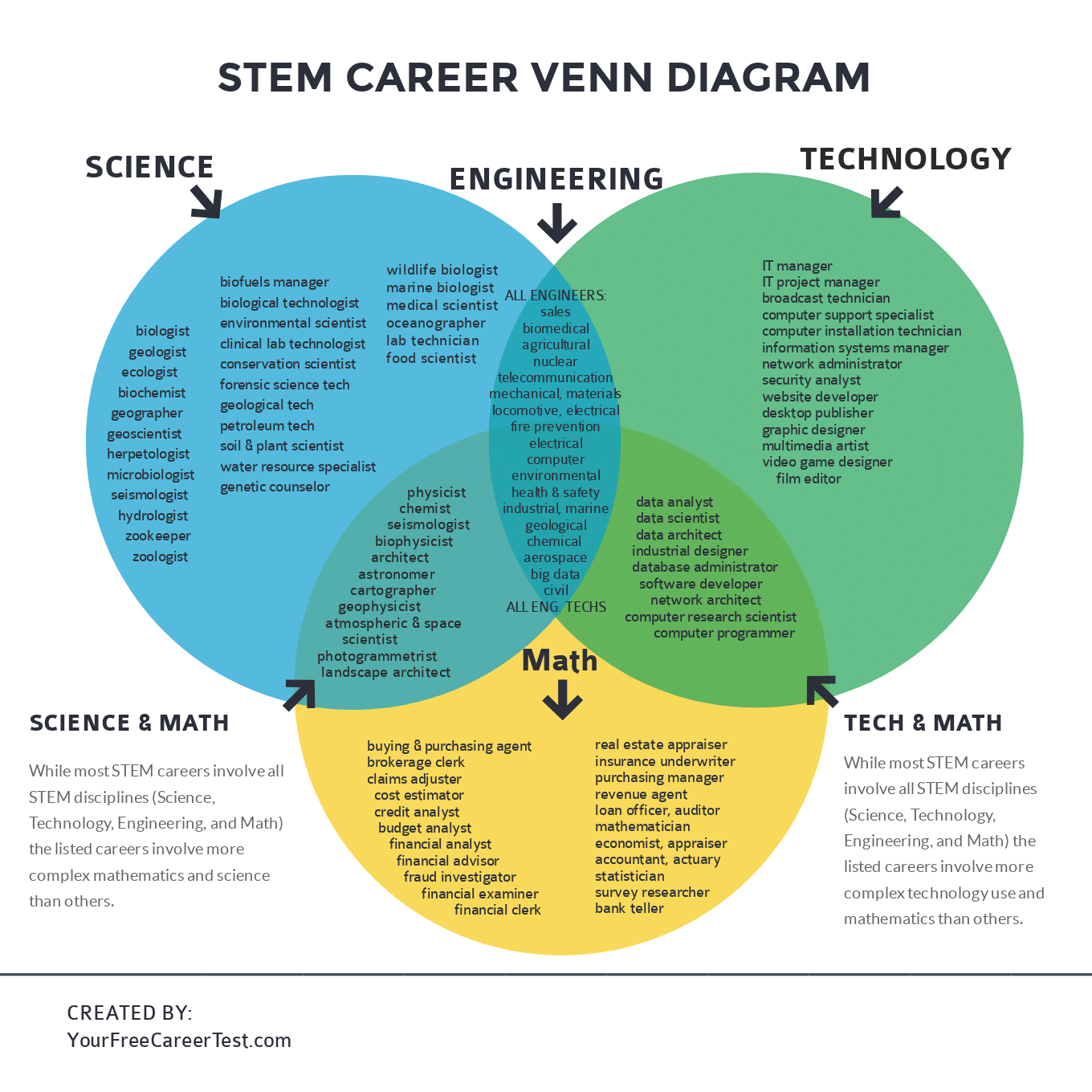

Results format: Again, this test is great for those of you who like to be thorough and that is reflected in the results as well. The results to this career test are quite informative, showing a wide array of information from the work environment best for you to the best field for you. This site provides detailed descriptions of the careers within each field. Lastly, this career test has a really neat STEM Venn Diagram showing the intersections between different types of STEM fields, and the careers that exist within each.

Career Test #3: Open Colleges

Time estimate: 5 minutes

Link: https://www.opencolleges.edu.au/careers/career-test

Signup required? No

Who would enjoy this career test? Those who care more about matching their personality with the right career than matching their skills with the right career.

Test format: This career test is a bit different from the traditional career test given that it is not really a career test so much as a personality test. The questions ask about your likes and dislikes, from interaction in crowds to organization levels, with no questions about skills or job types.

Results format: As this is test asks questions about personality, it is only fitting that the results are personality driven as well. The results come in the well-known Myers Briggs format consisting of a combination of four letters based on four categories (Introverted or Extroverted, iNtuitive or Sensing, Thinking or Feeling, Feeling or Perceiving). However, this career test provides more than the letters and actually includes a character profile with a neat name like “The Champion,” “The Performer,” and “The Idealist,” based on 16 personalities profiles. This personality profile includes strengths and weaknesses, typical careers, and famous people who had that personality type.

Career Test #4: 123 Test

Time estimate: 5-10 minutes

Link: https://www.123test.com/career-test/

Signup required? No

Who would enjoy this career test? Those considering a career change.

Test format:

Continuing with the theme, this test is different in structure to those suggested so far. Instead of relying on questions about personalities or skills, this career test is picture based and multiple choice. Each of 15 questions provides a picture and a description of four jobs or personality features. It is your job to select one that sounds like something you would enjoy, and one you would not enjoy. The other two are left blank.

Results format:

The results to this career test are given in the Holland Codes format. This format was popularized in the famous book for career changers and job searchers, What Color Is Your Parachute. The results come in the form of a pie chart broken into six pieces, each a component of your personality (investigative, artistic, realistic, social, enterprising, and conventional). Your Holland Code comes from listing the first letter of each component in the order they are ranked for you. From this code, similar to the previous career test, 123 Test offers descriptions of careers that people with that code usually excel in.

Career Test #5: My Next Move

Time estimate: 5-10 minutes

Link: https://www.mynextmove.org/explore/ip

Signup required? No

Who is would enjoy this career test? Job searchers and career changers

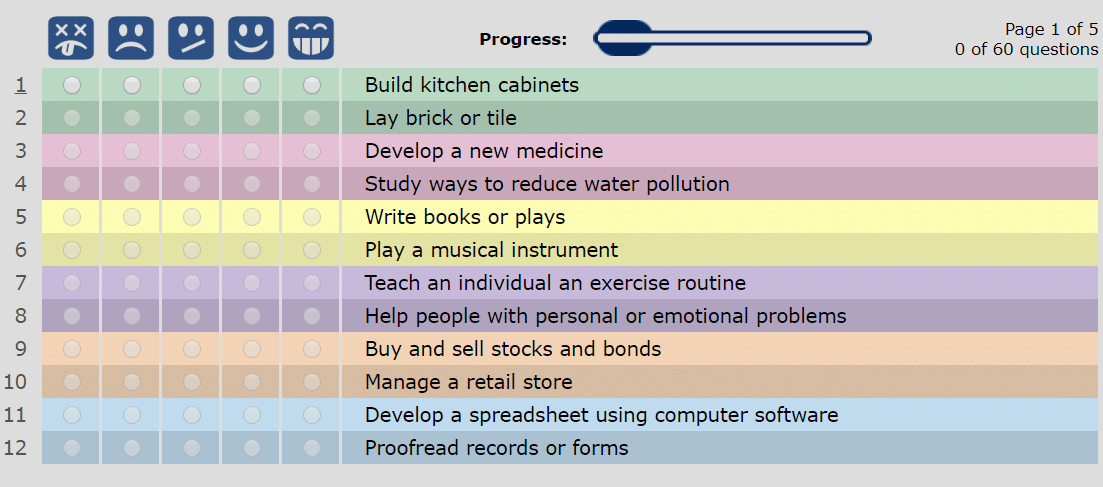

Test format:

This test is a bit of a combination of tests two and four. There are 60 questions, each one asking about a particular task. You rate each from really good to really bad using the emojis at the top as descriptors.

Results format: The results come back in the same categories as the Holland Codes in test 4. However, this test does not focus on combining the different categories. Instead, this test simply shows you how how many points each category accumulated. From there, you can read about each category and the types of careers that make them up.

Why Does RTSWS Care About Career Tests?

Rock The Street, Wall Street believes in opening doors for the next generation of women. By introducing them to female financial role models and providing them with real world STEM applications, we hand them keys to new doors. No matter which door our students walk through, they will be financially educated so they can be impactful with the money they earn.